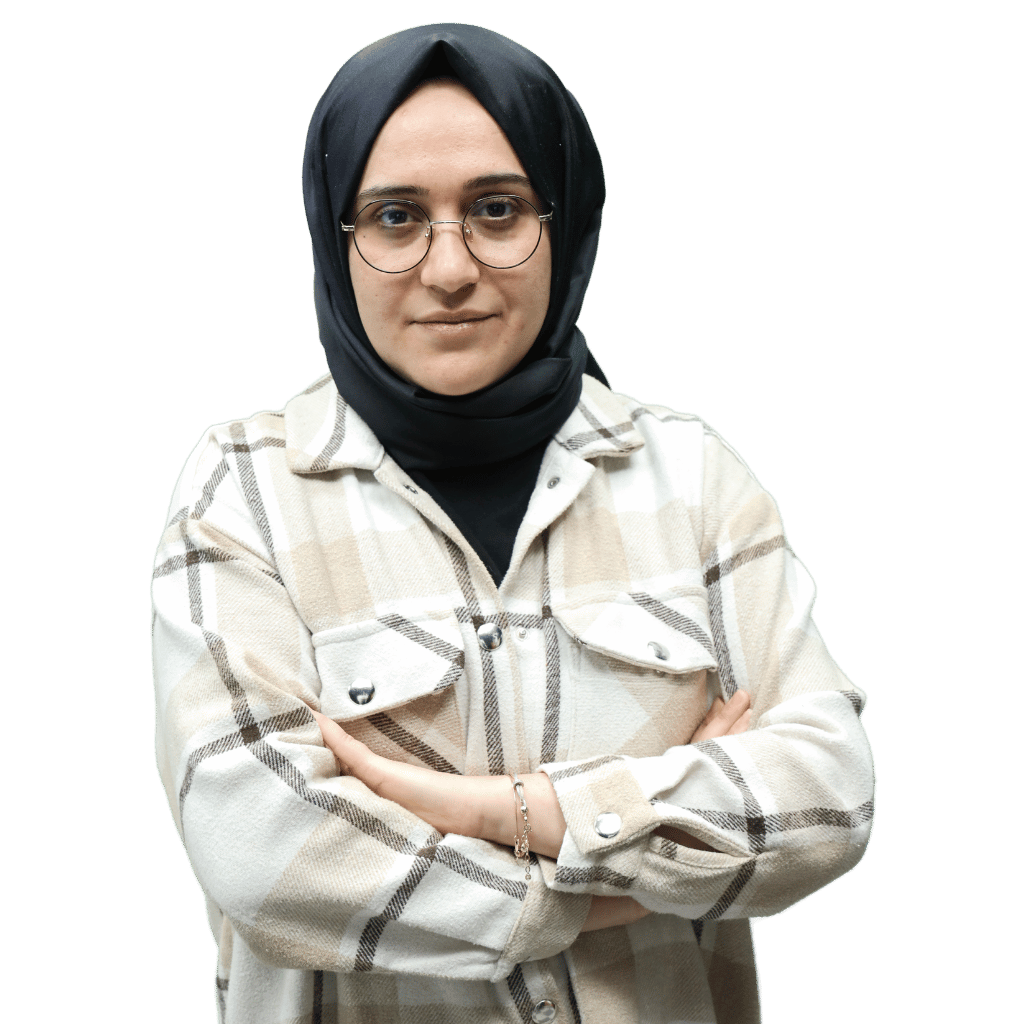

Asst. Prof. Melih Kutlu

Deputy Head of Department

Education: Ph.D 2017, Karadeniz Teknik University

Research Areas: Finance theory, portfolio management, business finance, financial markets and institutions, international finance. There are articles and book chapters on volatility and its spillover, especially in securities markets.

Selected Studies: He wrote his master’s theses named “Particle Swarm Optimization” (2012) and his doctoral theses “Static Financial Asset Pricing Models: An Application in Borsa Istanbul”. Relationship Between Foreign Direct Investment And Economic Growth in Developing Countries(2014), Doğrudan Yabancı Yatırımlar ve Portföy Yatırımları Volatilitesi Arasında Nedensellik İlişkisi (2015), The Effects of Gezi Park Protests on Turkey s Credit Default Swaps CDS (2016), Borsa Istanbul Tourism Index Volatility: Markov Regime Switching Arch Model (2019), Causality Relationship Between Stock Market and Real Sector in Turkey: A Cross Correlation Function Approach (2020), Dynamic Volatility Spillover between Stock Exchange and Interbank Market after the Global Crisis in Turkey (2020), Return and volatility spillover effects between the Turkey and the Russia stock market (2020).